With the COVID-19 crisis, almost ten million people have filed for unemployment in the course of two weeks. For some, this will last beyond “shelter-in-place,” since many small businesses will struggle to remain afloat after months of being closed, and others will reduce employment in the wake of the financial fallout.

How are we supposed to pay rent or mortgage if we are not working? So far, city and state ordinances in California and many parts of the country haven’t gone farther than making it harder for landlords to evict tenants who are struggling, and many are totally unprotected. Even in places like Oakland, with the “strongest” type of eviction moratorium, tenants will be expected to pay back rent as soon as the emergency order has ended.

Most people feel pressure to pay rent right now, using their savings, especially if they believe they will have to pay it back in full in a few months. This is unacceptable. As to people with mortgages, trying to hold onto their homes, they are told to come to an individual arrangement with their banks.

This crisis exposes what was already true: housing is a right, and there is no reason anyone should be forced to pay rent or mortgage when they’ve been deprived of an income through no fault of their own. We need to prepare for what is coming: mass unemployment and ultimately, evictions and foreclosures. Government officials have shown that they are not going to get us out of this mess; the Oakland moratorium has highlighted that all rents will have to be repaid. We will have to organize our forces locally and beyond, for the response that we need. If they can infuse the banks with billions, or rather trillions, they can solve the problem of rent and mortgage debt for those who are not earning an income.

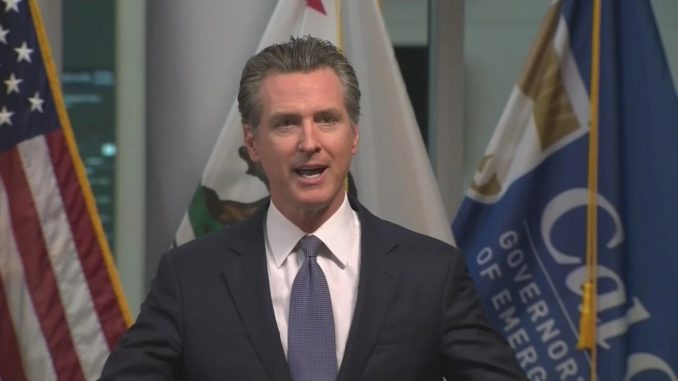

Featured image credit: CBS