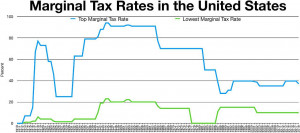

For all the media coverage of and right-wing hysteria about how the new Biden tax proposal for wealthy Americans will affect our economy, the real story of the proposed increases is that they still don’t get taxes back to the level they were in the 1950s, under a Republican president!

That’s right. Biden is proposing to raise the top marginal tax rates from a measly 37% to a paltry 39%. And corporate taxes would go up as well, from 20% to 39%.

While these proposals may be better than the status quo, to understand just how insufficient they are, and to see just how conservative Biden and the Democrats are, we need to compare these proposals to tax rates in the 1950s.

Throughout the 1950s, under Republican President Dwight Eisenhower, the top marginal tax rates for the wealthiest American’s were 92% and 91%. You read that right: 92% and 91%. This didn’t cause the world to fall apart, or the rich to starve, and at least some of these funds were used to benefit poor and working people.

So despite the hype or the doomsday predictions, let’s not believe that Biden is really trying to take on the rich to benefit us. There are plenty of examples of what he could try if this was his goal.