People think of April 15 as Tax Day because that’s when federal and state income taxes are generally due. If you get a refund, it’s only because you have been paying into the system all year.

Working-class people pay all year long, not just income taxes, but sales taxes on all kinds of things we need. If we own a home, we pay property taxes. If we rent our homes, part of that rent goes to pay the landlord’s property taxes. Part of the retail price that we pay for all kinds of things goes to pay for the retailers’ and wholesalers’ property taxes, and so on.

When you think about it, that’s just the beginning. Everyone has essential needs for running a household. But we get taxed on many of those needs. Consider gasoline. As of January 1, 2024, the federal tax plus the average state tax was just over 50 cents on a gallon of gas. You might think that businesses should pay that for their vehicles just like families do. But businesses, including huge corporations with vast fleets of vehicles, can deduct such expenses on their taxes. Working-class households can’t do that. So, this is one more way that working people are subsidizing the tax breaks of the corporations and the wealthy.

That is just one example. The non-partisan Institute on Taxation and Economic Policy has reported that at least 55 major U.S.-based corporations paid zero federal taxes on 2020 profits. Meanwhile, corporate tax avoidance schemes cost the U.S. government in the hundreds of billions of dollars. Globally, corporations moved nearly one trillion dollars in profits to tax havens like Hong Kong or the Cayman Islands, putting heavier burdens on ordinary people while depriving us of public services.

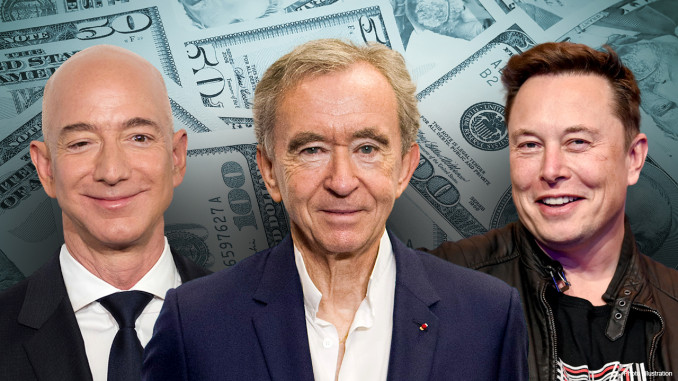

That’s the corporate side of it. On the personal side, billionaires in the U.S. are about 1.6 trillion dollars (46 percent!) wealthier today than they were in 2020. Part of the reason is how little they pay in taxes. A 2021 White House study found that the 400 wealthiest billionaire families in the U.S. had an average federal tax rate of 8.2 percent compared to the national average of 13 percent. A Pro Publica analysis found that the 25 wealthiest U.S. citizens paid a tax rate of 3.4 percent, about one-quarter of the national average.

So, the big bosses make their money off of us on the job by paying us less than the value we create for them. Then they make even more off of us by having their politicians, both Democrats and Republicans, manage a tax system that is stacked against us.

In his State of the Union address last month, Biden said, “No billionaire should pay a lower tax rate than a teacher, a sanitation worker, a nurse.” This was nothing but an election-year speech. It’s the same kind of thing Democrats always say, while Republicans generally argue that lower taxes for the rich will trickle down to mean jobs for workers.

Let’s look at the reality. The capitalist system by definition means profiteering by the few at the expense of the many. The government, in the hands of the Democrats or the Republicans, supports that profiteering.

How do they help us? Not by solving the climate crisis or preventing nuclear war. Not by providing good health care, education, nutrition, and housing for all. Not by providing essential infrastructure and services. In fact, while the Francis Scott Key Bridge was crumbling into the Port of Baltimore, the government of Maryland was planning to spend one billion dollars on a new Baltimore jail!

No, this system is not about providing what the majority of people need. It is about making the rich richer. It’s much worse than useless. We need to get rid of it.